Medicare Explained

Medicare is health insurance for people aged 65 or older, people under 65 with certain disabilities, and people of any age with End-Stage Renal Disease (ESRD).

ESRD is permanent kidney failure that requires dialysis or a kidney transplant.

There’s a lot that needs to be learned when it comes to Medicare. It can be overwhelming at first, so it’s important that you research and ask any questions that you have. You can always reach out to us and we’ll help you feel confident in your decisions.

Medicare Is Divided into Four Parts

Part A

Hospital Coverage

Part B

Medical Coverage

Part C

Medicare Advantage Plans

Part D

Prescription Drug Plans

Then, there are Medicare Supplement Plans, which we’ll get into later.

Book an Appointment Today!

By submitting this form and providing this information, you agree that an authorized representative or licensed insurance agent may contact you. This is a solicitation for insurance.

How to Get Medicare Parts A and B

One of the most important decisions you have to make is how you are going to get your Medicare benefits.

There are two ways to get Parts A and B.

Option 1:

- Get it from the government (stay on Medicare)

- known as Original Medicare

Option 2:

- Get it from a private insurance company

- Known as a Medicare Advantage plan (Part C)

Many people are surprised to learn that Original Medicare is NOT full coverage!

Parts A and B have limited coverage, no maximum out of pocket limit, and do not provide benefits for dental, hearing aids, or long-term care.

Fortunately, you can solve this problem by getting a Medicare Advantage plan or purchasing a Medicare Supplement plan.

Medicare Eligibility

Eligibility for Medicare is primarily based on age. The typical enrollment age is 65, which is when many people will be automatically enrolled. Whether or not you’re automatically enrolled will depend on your tax history. If you’re receiving Social Security benefits, then you can be sure that you’re eligible to get Medicare benefits. You can choose how to get your coverage, which can be great and confusing at the same time!

Original Medicare Cost-Sharing

Medicare isn’t free. There are certain costs that must be paid in order to maintain your coverage. Premiums are a monthly amount that you will need to pay whether or not you seek any medical care. If you stop paying your premiums, then you risk losing your health insurance coverage.

For someone that stays on Original Medicare, under Medicare Part B there is an:

- Annual deductible

- Coinsurance of 20% of the Medicare-approved charges

So, if you’re on Original Medicare and have $100,000 of Part B charges, you owe 20% or $20,000.

Medicare Enrollment

There are certain times of the year that you can enroll in Medicare, known as “enrollment periods.” You’ll want to mark the important dates on your calendar so you can avoid any late penalties and get the coverage you need for the coming year. Learn more about the enrollment periods here.

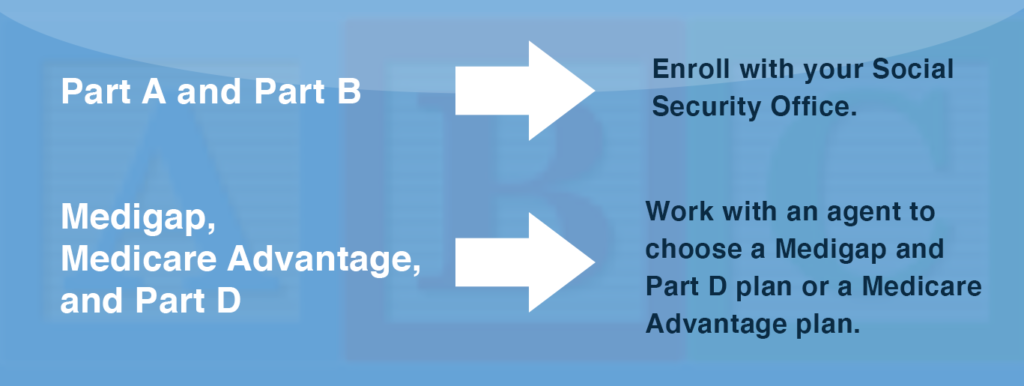

Medicare enrollment can be confusing — when and who you enroll with will depend on your needs, location, and budget.

If you’re enrolling in Original Medicare, then you can do so through Social Security, either online, over the phone, or in person at your local SS office. However, if you’re wanting to enroll in Medicare Advantage, then you’ll need to do so through a private insurance agency. They’ll be able to provide you with information and help you select the right type of policy for your medical needs.

ABC Medicare Can Help

We’re located in Lawton, Oklahoma, and can help with your Medicare insurance needs. If you’re ready to get started or you want to make changes to your plan, make an appointment with us online. We’ll get back to you shortly!

In the meantime, please keep browsing our website to learn more about your Medicare plan options.