Medicare Part D

Have you ever gone to the doctor and gotten a prescription to get it filled and were surprised at how much it costs? That happens to nearly everyone.

Original Medicare (Parts A and B) doesn’t cover prescription drugs. That’s why Part D exists. An easy way to remember it is that the “D” stands for drugs.

Medicare prescription drug coverage is optional but very important. It can only be obtained through private insurance companies. You cannot get a Part D plan from the government.

Medicare Part D Overview

💊 These plans help cover the cost of prescription drugs

💊 Each plan has its own list of covered drugs (formulary)

💊 The cost-sharing varies by plan

Tiers

To reduce costs, many plans place drugs into various “tiers” on their formularies. Drugs in each tier will have different costs. For instance, a drug in a lower tier will be more affordable than a drug in a higher tier. Below is an example of a Medicare drug plan’s tiers:

- Tier 1 — lowest copay: most generic prescription drugs

- Tier 2 — medium copay: preferred, brand name

- Tier 3 — higher copay: non-preferred, brand name

- Specialty tier — highest copay: very high cost

Book an Appointment Today!

By submitting this form and providing this information, you agree that an authorized representative or licensed insurance agent may contact you. This is a solicitation for insurance.

Avoid the Lifetime Penalty

With Medicare Part D, there is a lifetime penalty that you want to avoid! We often find people who are having to pay a penalty for the rest of their life because they didn’t know this very important rule.

Once you qualify for Medicare, if you ever go 63 days without creditable drug coverage or a Part D plan, and you later want to enroll in a Part D plan, you’re going to pay a penalty for the rest of your life. So even if you’re taking any prescription meds now, we recommend getting a Part D plan when you’re first eligible for Medicare.

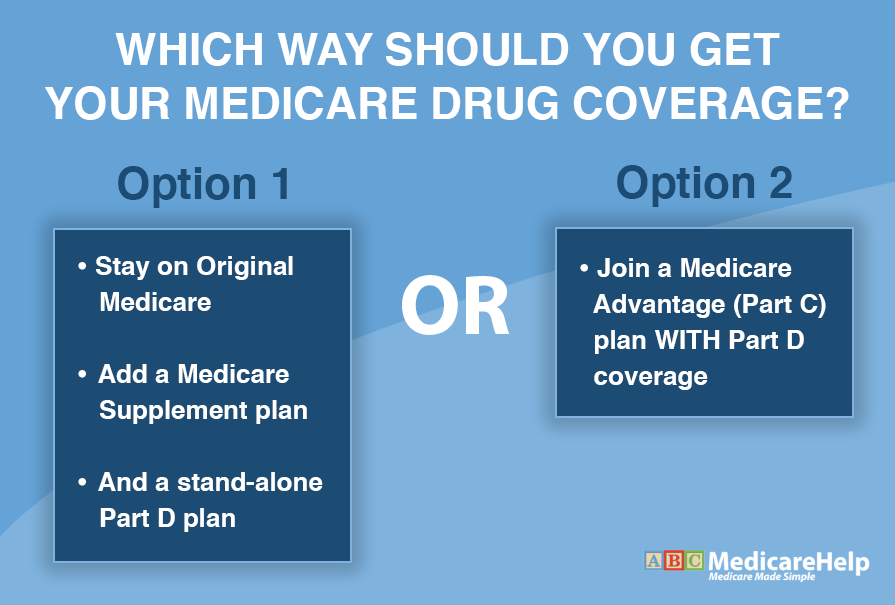

How to Get Medicare Drug Coverage

Option 1

With option 1, you basically prepay for treatment. You pay every month whether or not you go to the doctor. You pay a significant amount of money to the insurance company whether you use the plan or not.

Option 2

With option 2, it’s more of a “pay-as-you-go” thing. So, you have little to no premium.

We Can Help

No matter which direction you feel is best, our agents can help you.

There are a lot of insurance agents out there who sell Medicare Supplement plans, but they are not certified to help people with their Part D coverage, and they CANNOT offer Medicare Advantage plans.

We do Medicare. We help people figure out which direction will be best for them. And no matter which direction you’ve gone, we can help you save money in that choice — by helping you compare your plans every year.

Comparing Part D Plans

There are many factors to consider when comparing Part D plans.

The first is: Are my medicines covered? The formularies, deductibles, and copays are different from one plan to another.

We’ve helped many people save THOUSANDS of dollars per year on their prescription drug plan costs by helping them enroll in the right drug plan.

About the Extra Help Program

Do you or someone you know have limited income? If so, you may be one of over a million people in this country who qualify for Extra Help and are unaware of it.

The prescription drug Extra Help program is through Social Security and is worth about $5,000 per year, per person.

- It helps cover deductibles

- Helps pay drug plan premiums

- Copays are based on the level of Extra Help (forget about copays)

We don’t just tell people about it — we help people enroll! The income limit for this program is much higher than it is for Medicaid.

Schedule a No-Cost Consultation

Medicare Part D can be complicated, but you don’t have to navigate it on your own! Schedule a FREE consultation with ABC Medicare. We’ll help you compare and pick the plan that is right for you.