Medicare vs. Medicaid

Health insurance is one of the most important things to have. Preparing for the future, and the unexpected, is essential. And that’s what purchasing an insurance policy is all about. Having the proper health coverage will give you peace of mind, knowing that if/when you need medical care, you won’t be faced with substantial out-of-pocket costs.

There are multiple ways to obtain health insurance. Many people get a policy through their employer, but that does end during retirement. At that point, people will need to find another health insurance plan. If you don’t have coverage through your employer, then it’s possible to purchase health insurance on your own. You can do this through an insurance agency. It’s also possible to purchase short-term health insurance if you’re between employers but still want access to coverage.

There are also health insurance programs offered through the federal government: Medicare and Medicaid. Many people do not know the differences between the two. We’ll help you understand how they differ and tell you whether you qualify so you can get the right coverage for your situation!

Medicare

Medicare is health insurance for people age 65 and older, and under 65 with certain disabilities. The main factor for Medicare eligibility is age.

Original Medicare consists of Part A (hospital) and Part B (medical), and you can sign up through Social Security. Some people are automatically enrolled.

Book an Appointment Today!

By submitting this form and providing this information, you agree that an authorized representative or licensed insurance agent may contact you. This is a solicitation for insurance.

Medicaid

Medicaid is primarily intended for those in lower-income brackets. It can cover many typical medical costs, so if you’re eligible, this is a great way to save money while getting the benefits and care you deserve. You can find out if you qualify for Medicaid online.

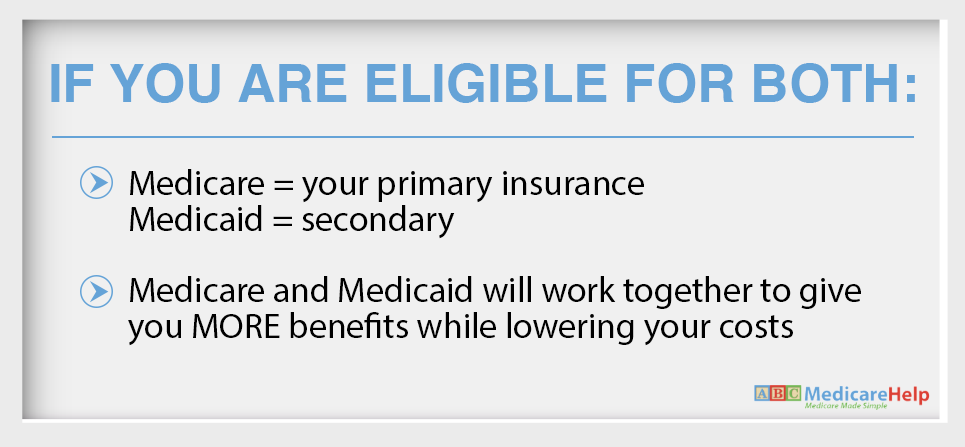

Dual Eligibility

Some people qualify for Medicare and Medicaid, and we call them dual-eligibles. If this is true for you, you can contact an agent who has access to a unique type of Medicare Advantage plan: the Dual-Eligible Special Needs Plan (D-SNP). These plans allow you to keep all your Medicare and Medicaid benefits, and may include additional benefits for dental care, hearing aids, wellness programs, and so on. All Special Needs Plans will include prescription drug coverage as well.

Again, reach out to an insurance professional to find out if you qualify for both programs.

Similarities and Differences in Coverage

Medicaid covers Medicare-related expenses, like benefits if you’re hospitalized and necessary medications. Medicaid also offers coverage for custodial and nursing home care, but Medicare does not.

Medicaid coverage varies by state, but each state is required to cover the following:

- Lab work

- X-ray diagnostic services

- Transportation to a healthcare facility

- Nursing home and home health care

- Inpatient and outpatient hospital care

- Tobacco recess counseling for pregnant women

If you have a loved one who needs long-term care, find out if they’re eligible for Medicaid. Medicare provides limited coverage for seniors in nursing homes.

Note: Medicaid cost-sharing differs from Medicare cost-sharing.

Learn More About Medicare and Medicaid Benefits

Being able to differentiate between Medicare and Medicaid is important. They’re both excellent health insurance options intended for different groups of people. If you’re feeling confused about the differences between these options, we’re here to help. We can answer your questions and make sure that you have the information you need to make an informed decision. Call us or fill out our contact form today!