Original Medicare: Parts A and B

When it comes to Medicare, there are a few things that you must know. First, a very important decision you’ll make is HOW you decide to get your benefits.

There are two ways to get Parts A and B of Medicare:

- Get it from the government. This means you stay on Medicare.

- Get it from a private insurance company. This is known as Medicare Advantage.

Option #2 is worth considering because Original Medicare offers limited coverage, has no maximum out of pocket limit, and does not provide benefits for dental, hearing aids, or long-term care.

If you choose option 1, you can add a Medicare Supplement (Medigap) plan to help fill the gaps in coverage. These may include deductibles, copayments, and coinsurance for Parts A and B. And, you can add a stand-alone Part D plan (Medigap doesn’t cover prescription drugs).

The bottom line is: If you don’t have something besides Original Medicare, you’re taking a big financial risk.

Book an Appointment Today!

By submitting this form and providing this information, you agree that an authorized representative or licensed insurance agent may contact you. This is a solicitation for insurance.

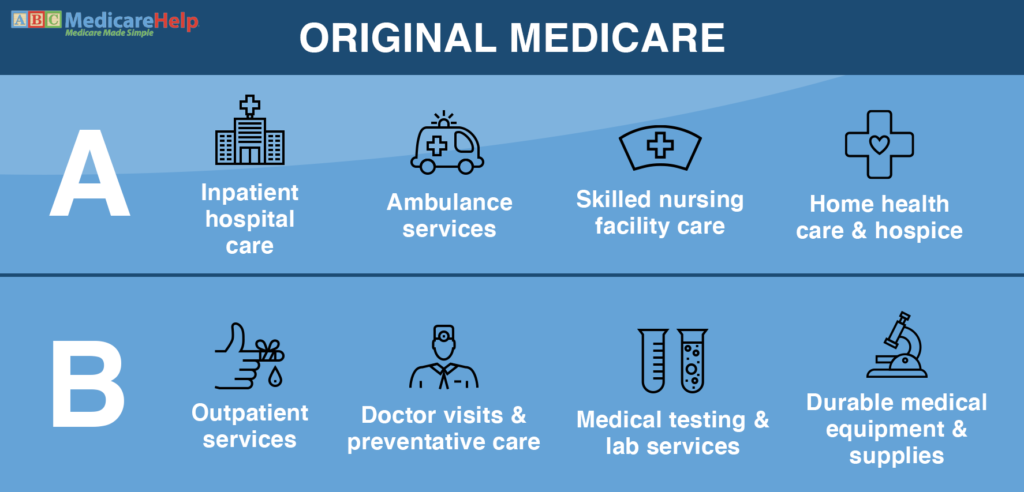

What Does Part A Cover?

Part A covers most inpatient care, including care provided in hospitals and skilled nursing facilities. Hospice and home health are included as well. The degree to which coverage shifts often depends on the length of the inpatient stay. Medicare coverage will typically diminish as a stay lengthens, so that’s something which is important to keep in mind if you’re going to be at an inpatient facility for months at a time.

Is Part A Free?

If you or your spouse have worked full-time for 10 or more years over a lifetime, you will likely get Medicare Part A premium-free. If not, you will pay up to $471 every month.

What Does Part B Cover?

Part B includes both durable medical equipment (walkers, wheelchairs, etc.) and preventative and medically necessary services. Durable equipment and supplies is an area of coverage that could potentially save you thousands, depending on your situation. Other things that Part B includes are lab tests, ambulance rides, and mental health services.

Medicare Part B Premium

Part B is available at a monthly rate, which Congress sets each year. People with certain high incomes will pay more for Part B.

When Do You Enroll?

It’s vital to understand the seven-month Initial Enrollment Period (IEP) surrounding your 65th birth month. You have the three months before you turn 65, your birthday month, and the three months after to enroll in Original Medicare — without documentation.

Part B Penalty

Most of the time, if you don’t enroll in Part B when you’re first eligible, you’ll need to pay a late penalty for as long as you have medical coverage. Your monthly premium may increase by 10% for each full 12-month period that you COULD HAVE had Part B, but didn’t enroll.

You may also have to wait until the General Enrollment Period, which is January 1 to March 31, to sign up for Part B. Coverage will kick in on July 1 of that year.

What If You're Still Working at Age 65?

If you’re still actively working at 65 and have employer health coverage, in most cases you don’t have to sign up for Medicare Part B yet. Once you stop working, you’ll be given a special enrollment period of eight months after your employment ends in which to enroll.

A-B-C, Easy as 1-2-3

If you have questions about Original Medicare or are wondering which additional coverage option will work best for you, contact ABC Medicare. We can give you answers and the information you need to feel confident in your decisions. We make Medicare insurance easy! Just email Aaron@ADyoungllc.com or call (580) 248-5708 to get started.