PPO vs. HMO Plans

There are different ways to get your Medicare benefits. You may have heard of Medicare Advantage, or Medicare Part C, which is a private version of Medicare. These are plans offered by private insurers, and they can combine your hospital, medical, and prescription drug coverage into ONE convenient program. Your plan may offer additional benefits as well.

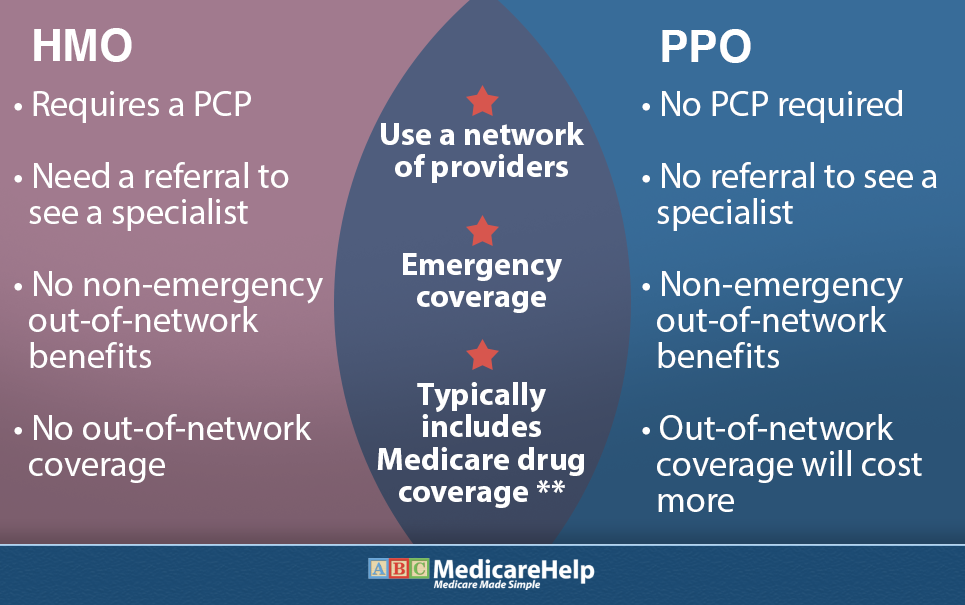

Two of the most popular types of Medicare Advantage plans are HMOs and PPOs. ABC Medicare will compare and contrast these two types so you can decide which one makes more sense for your situation.

Overview

Both types of plans provide in-network coverage, and the main deciding factors between them is how strict they are and whether or not they require the beneficiary to get a referral to see a specialist.

Book an Appointment Today!

By submitting this form and providing this information, you agree that an authorized representative or licensed insurance agent may contact you. This is a solicitation for insurance.

PPOs

Preferred Provider Organization (PPO) plans are an extremely popular option. While there is a network that’s provided in a PPO, it’s less strict. This means that it’s possible to receive care out-of-network and still have coverage. However, coverage may not always be the same as if you had gone to an in-network provider, and out-of-network coverage will cost more.

The majority of PPOs cover prescription drugs. A stand-alone Part D plan isn’t available for those that are enrolled in Medicare Advantage. So, if you want prescription drug coverage, you’ll need to make sure that it’s included in your Advantage plan. You may hear these referred to as MAPDs.

Another unique feature of PPOs is that beneficiaries don’t have to officially select a primary care physician (PCP). One of the reasons for this is that PPOs don’t ask their beneficiaries to get a referral if they need to see a specialist.

HMOs

There are a few defining characteristics that separate HMOs and PPOs. One difference is that HMOs are more strict about network coverage. With only a few exceptions, beneficiaries are asked to go within the plan’s network of doctors and hospitals. If you choose to go outside of the network, you most likely won’t have coverage. HMOs do ask beneficiaries to select a primary care physician, so that they will have someone to get referrals from.

Venn Diagram - Plan Comparison

Which Plan Is Right for You?

If you like the idea of having a bit more freedom to choose doctors, hospitals, and other healthcare providers, a PPO plan may be the better choice for you.

If you’d rather pay a lower premium and don’t mind if your care is managed by someone else, then an HMO may suit you better.

Medicare PPOs and HMOs come with pros and cons. Consider which type of plan would best suit your needs, budget, and location when doing your search.

Consult a Professional

Feeling overwhelmed about Medicare decisions? You’re not alone.

Whether you’re new to Medicare or have had a policy for years, you deserve attention from a dedicated insurance professional. ABC Medicare & Health Insurance Agency is an industry leader — you can reach us over the phone, online, or by email. We’re located in Lawton, Oklahoma, and ready to help you with all of your health insurance needs!